Denial of claims due to glitches that occur somewhere along the Revenue Cycle Management (RCM) process can cause a real dent in the fiscal health of your practice. Fallouts of such losses can be manifold, including a lack of sufficient resources to achieve the excellence of care management services that you aim to provide your patients. To mitigate these flaws, we present to you the top 5 changes that you can implement in your RCM processes.

Errors in the documents attached, submission of incomplete claims and coding issues can be a real menace especially since they all lead to one single dreadful outcome – denial of claims. A very high rate of claims rejection can bleed your organization into oblivion as it affects the inflow of cash that is required to sustain a healthy practice. In addition to denial of claims, inefficiencies in the RCM processes also cause errors like missing items in the form of services and supplies in submitted claims. Such slippages can drain the organization financially and can be very detrimental to growth.

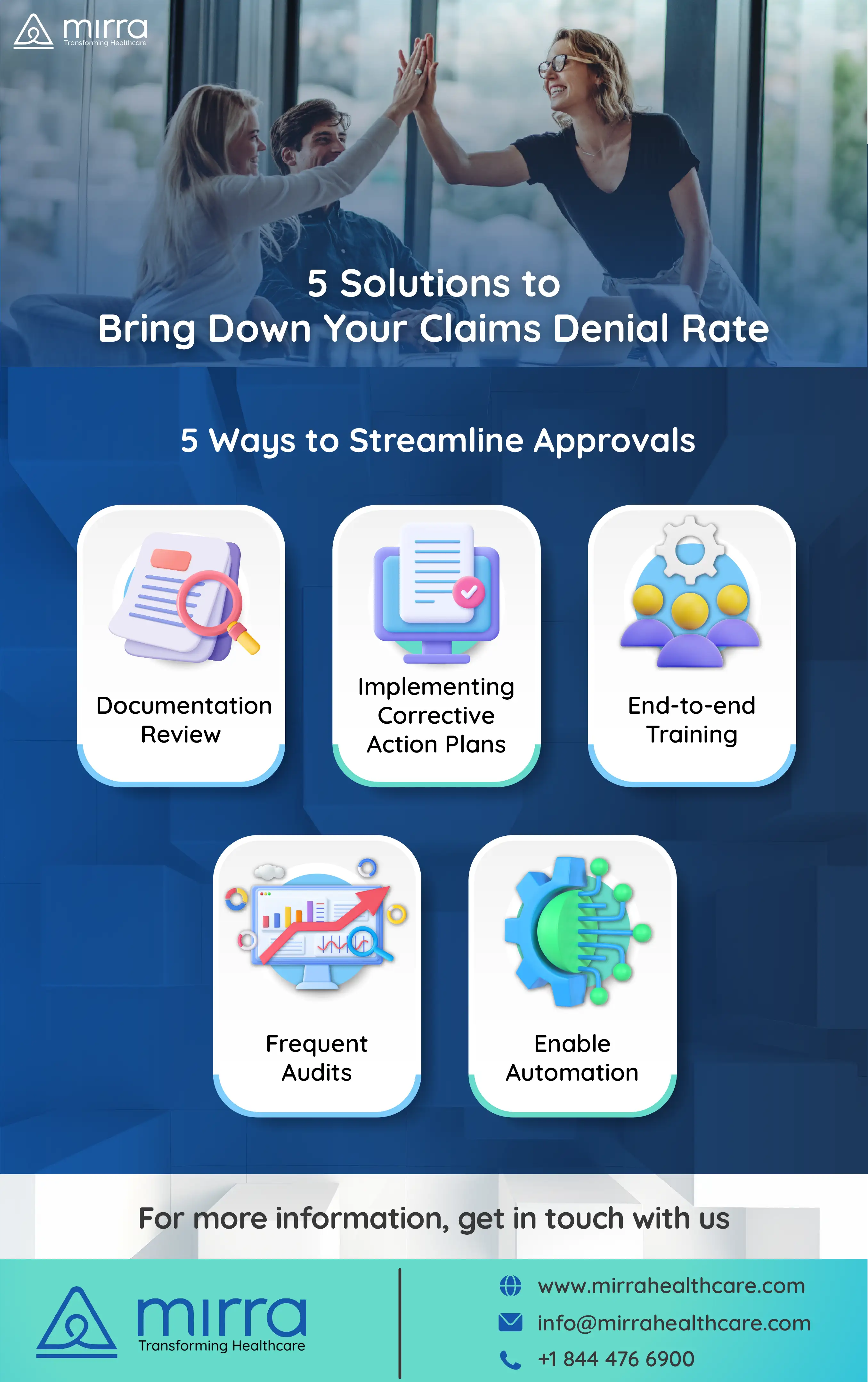

Here are a few proposed solutions for inadequacies that plague RCM processes in most healthcare outfits across the country –

1. Documentation Review – Regular double-checking documentation that needs to be prepared as part of the claims submission process can help infinitely in eliminating errors that can eventually lead to claims denial.

2. Adequate Training – Often it is the lack of proper training and guidance that leads to coders, physicians and administrative staff committing slipups in the documentation that is the basis of all claims. A periodic training program that aims at educating staff members is a solid starting point for lowering the claims denial rate.

3. Frequent Audits – Coding processes and methods need to be whetted every few months to eliminate issues like over or underpayments, incorrect diagnosis, and lack of adherence to current regulations.

4. Documenting Corrective Action Plans – Drawing corrective action plans using the findings of audits is a good practice. These plans prove fully effective when they are precisely documented and disseminated amongst the concerned staff so that they can imbibe absorb the learnings in their everyday work.

5. Automate – Investing in technological tools that help ease the process of preparation of claims as well as automatically check the accuracy of information being submitted are a step in the right direction as far as reducing revenue loss due to claims denial is concerned.

Most organizations lack the expertise required to roll out the solutions provided above to iron the issues dotting their RCM processes. This is where Mirra Health Care (TPA) can step in to help healthcare entities work out their RCM issues without having to spend too much time and effort in figuring out the nitty-gritty details of the change process from scratch. Armed with a posse crew of experienced professionals who are masters of the RCM processes, Mirra can swoop in and quickly help you design and implement changes that will reduce your claims denial rate dramatically and boost the financial status of your organization.

For more information on how you can partner with Mirra and access our Medicare in a Box service, get in touch with us - Contact US