Did you know that the success of healthcare organizations hinges on more than just providing quality patient care management services? It's all about managing their revenue cycle effectively. You're in the right place if you've ever wondered how healthcare providers optimize their financial outcomes. This blog post delves into revenue cycle management in healthcare and shares actionable strategies that can transform your healthcare numbers.

From understanding the interconnected revenue cycle stages to identifying common challenges providers face, we'll look into different aspects. We'll share practical insights on patient registration, coding and documentation, charge capture, denial management, patient billing, and understanding of analytics. So, let's get started.

Understanding the Revenue Cycle

It is the backbone of financial operations in healthcare organizations. By understanding its key components and stages, we can unlock valuable insights into how revenue is generated and identify opportunities for improvement.

Key Components of the Revenue Cycle

- Patient Registration: Accurate and thorough patient registration is essential for proper billing and eligibility verification. Collecting complete insurance information and verifying coverage upfront can prevent billing issues later.

- Coding and Documentation: Accurate coding and documentation are vital for proper reimbursement. Following proper coding practices and implementing documentation improvement strategies can ensure that healthcare services are correctly captured and billed.

- Charge Capture and Claims Submission: Streamlining charge capture processes and minimizing errors significantly optimize revenue. Electronic claims submission and automation tools can help streamline this stage and reduce claim rejections.

- Denial Management: Proactive denial management is crucial for revenue cycle success. Analyzing the root causes of denials and making process improvements can significantly reduce denial rates. Additionally, understanding the appeals process and effectively appealing denials can maximize revenue recovery.

- Patient Billing and Collections: Best practices in patient billing enhance transparency and convenience. Clear and concise statements, transparent communication, and convenient payment options can improve patient satisfaction and prompt payment.

- Technology and Analytics: Leveraging technology, such as revenue cycle management software and analytics tools, can optimize revenue cycle performance. Automation, real-time data analysis, and reporting capabilities can help identify trends, detect inefficiencies, and drive continuous improvement.

The Interconnectedness of Revenue Cycle Stages

It's important to note that each revenue cycle stage is interconnected and influences the others. For example, inaccurate coding and documentation can lead to claim denials, affecting revenue generation. By recognizing these interdependencies, healthcare organizations can develop holistic strategies for revenue cycle optimization.

Identifying Challenges in Revenue Cycle Management

Effective revenue cycle management in healthcare is not without its challenges. Healthcare organizations face various hurdles impacting revenue generation and overall financial success. Organizations can improve their revenue cycle performance by understanding and addressing these challenges with the help of a trustworthy third-party administrator like Mirra Health Care. Let's explore some common revenue cycle challenges and their impact.

Claim Denials

Claim denials occur when insurance companies reject submitted claims. These denials can stem from errors in coding, incomplete documentation, or lack of medical necessity justification. Claim denials result in delayed or lost revenue, increased administrative costs, and strained payer relationships.

Example: According to a study, claim denial rates range from 0.2% to 49% for commercial insurers, and denial rates can be even higher for Medicare and Medicaid claims.

Actionable Solution: Implementing proactive denial management prevention strategies, such as conducting root cause analysis, improving coding and documentation practices, and streamlining workflows, can reduce denial rates and increase revenue recovery.

Billing Errors

Billing errors, including inaccurate coding, incorrect patient information, and mismatched services and charges, can lead to claim rejections or underpayments. These errors hinder revenue cycle efficiency and can result in revenue leakage.

Example: The Apex EDI estimated that billing errors can lead to annual revenue losses as each up to 49% medical bills contain at least one error.

Actionable Solution: Focus on enhancing patient registration processes to ensure accurate information collection. Implement regular coding audits, invest in staff training, and leverage technology solutions to minimize billing errors and optimize revenue capture.

Inefficient Processes

Inefficient revenue cycle management processes can delay claim submission, payment posting, and patient billing. Manual processes, lack of automation, and outdated systems contribute to inefficiencies, increasing administrative burdens and hindering revenue cycle performance.

Example: A good number of healthcare organizations struggle with outdated revenue cycle management technology, which negatively impacts their financial performance.

Actionable Solution: Streamline charge capture and claims management through electronic systems and automation tools. Adopt revenue cycle management software that offers integrated scheduling, billing, and analytics solutions to enhance efficiency and accuracy. Get help from us at Mirra Health Care.

Addressing these revenue cycle challenges is crucial for healthcare organizations to maximize revenue and improve financial stability. The next section will discuss key strategies to boost your revenue cycle and overcome these challenges effectively.

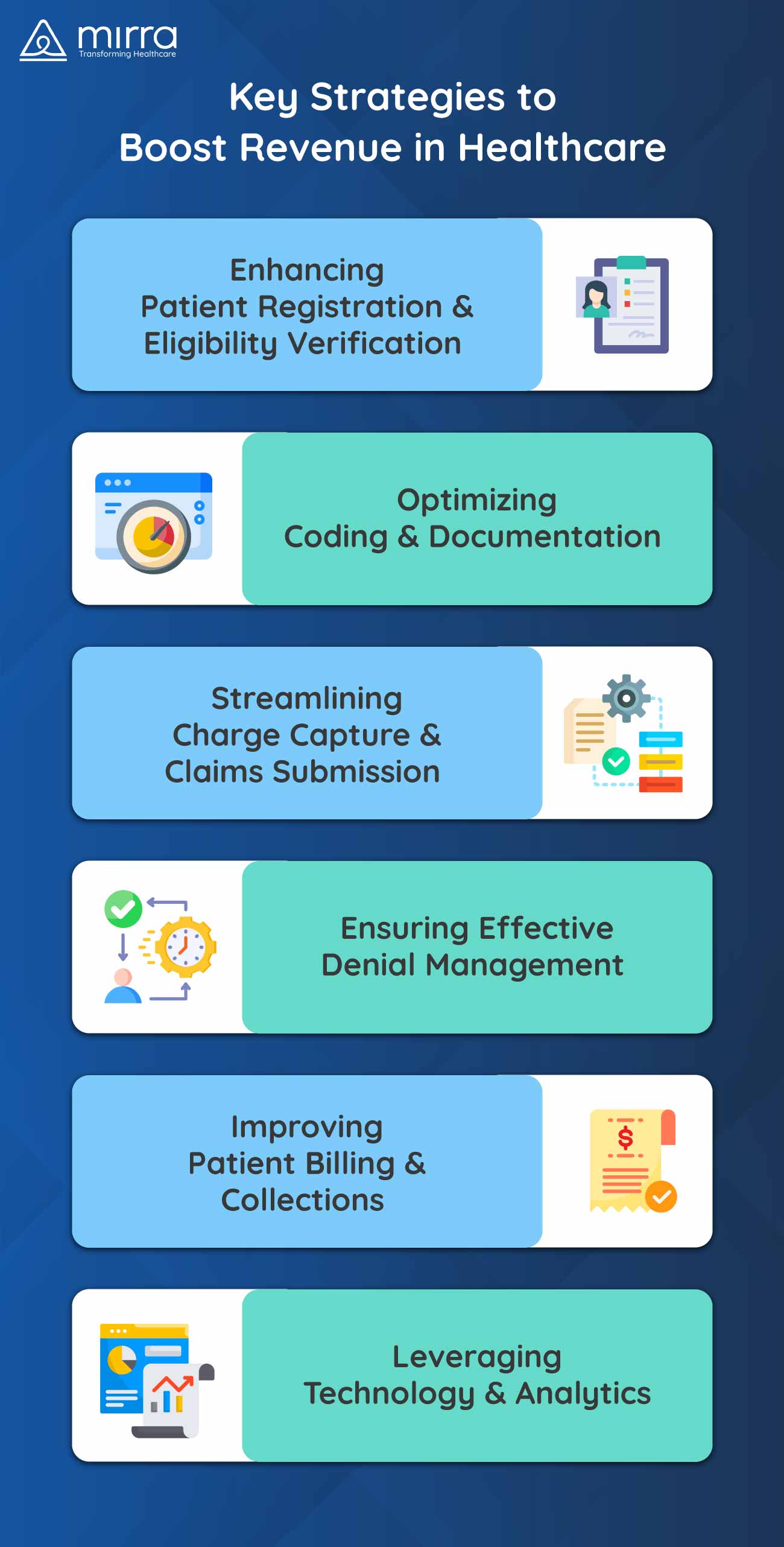

Key Strategies for Boosting Your Revenue

To achieve outstanding success in revenue cycle management, healthcare organizations must employ key strategies that address the challenges faced in revenue cycle management. Let's explore these in detail:

Enhancing Patient Registration and Eligibility Verification

- Educate registration staff: Provide comprehensive training on capturing complete insurance information, verifying coverage, and obtaining necessary authorizations.

- Utilize technology solutions: Implement electronic registration systems that can automatically validate insurance information and detect potential errors or inconsistencies.

- Engage patients in the process: Encourage patients to provide accurate and up-to-date insurance details during registration. Communicate the importance of insurance coverage verification and potential financial implications.

Optimizing Coding and Documentation

- Regular coding audits: Conduct periodic audits to identify coding errors and areas for improvement. Implement corrective actions and provide feedback and training to coding staff.

- Documentation improvement programs: Develop programs to enhance clinical documentation, ensuring that it supports the level of service provided and justifies medical necessity.

- Collaboration between coders and clinicians: Foster communication and collaboration between coders and clinicians to ensure accurate and complete documentation.

Streamlining Charge Capture and Claims Submission

- Automated charge capture: Implement electronic systems that capture charges automatically at the point of care, reducing the risk of missed charges or coding errors.

- Electronic claims submission: Leverage electronic claims submission to minimize manual errors and expedite claim processing. Electronic submission also enables tracking and follow-up on claim status.

- Utilize automation tools: Employ revenue cycle management software with built-in automation features, such as charge scrubbing and validation, to enhance accuracy and reduce manual intervention.

Effective Denial Management

- Root cause analysis: Identify the underlying causes of claim denials through root cause analysis. Analyze patterns and trends to address systemic issues contributing to denials.

- Process improvements: Implement process enhancements, such as staff training, standardization of workflows, and clear communication channels, to reduce the likelihood of future denials.

- Timely appeals: Develop a robust appeals process to challenge unjustified denials promptly. Ensure that appeals are supported by accurate documentation and persuasive arguments.

Improving Patient Billing and Collections

- Clear and concise statements: Provide easily understandable statements outlining services rendered, charges, and payment due dates.

- Transparent communication: Engage in clear and open communication with patients regarding their financial responsibilities, insurance coverage, and available payment options.

- Convenient payment options: Offer flexible payment options, such as online portals, payment plans, or electronic fund transfers, to facilitate timely and convenient payments.

Leveraging Technology and Analytics

- Revenue cycle management software: Implement comprehensive software solutions that integrate various revenue cycle functions, including scheduling, registration, billing, and analytics. These systems automate processes, reduce errors, and improve efficiency.

- Reporting and performance monitoring: Generate regular reports on key performance indicators (KPIs) to track progress and identify areas for improvement. Monitor metrics such as claim acceptance rate, denial rate, and average reimbursement time.

Measuring Success and Continuous Improvement

To ensure the long-term success of your revenue cycle management efforts, measuring performance and continuously striving for improvement is crucial. Consider the following points for measuring success and driving continuous improvement:

- Key Performance Indicators (KPIs): Monitor KPIs such as claim acceptance rate, denial rate, clean claim rate, and average reimbursement time. These metrics provide insights into the effectiveness of your revenue cycle processes.

- Trend Analysis: Analyze trends over time to identify patterns and deviations from expected benchmarks. Identify areas of improvement or potential bottlenecks.

- Industry Benchmarks: Compare your organization's performance against industry benchmarks to gain a broader perspective. Identify areas where you can surpass industry standards.

- Stakeholder Feedback: Gather feedback from staff, patients, and payers to understand their experiences and identify areas for improvement. This feedback can guide process enhancements and help meet the expectations of all stakeholders.

To Sum Up

In conclusion, effective revenue cycle management is vital for the financial success of healthcare organizations. Each aspect contributes to optimizing revenue generation, from accurate patient registration to streamlined charge capture, denial management, and leveraging technology.Act today to enhance your revenue cycle processes, reduce errors, and optimize patient billing and collections. Mirra Health Care, a leading third-party administrator, is committed to delivering industry-leading solutions, including our premium billing services under the comprehensive Medicare Advantage in a Box umbrella.

With our expertise in revenue cycle management and claims adjudication, we can help your business reach new heights of success. Don't hesitate to contact us now and schedule a demo to experience the transformative difference we can make for your organization.