Managing Medicare Advantage (MA) billing with precision and efficiency can be challenging. Manual data entry, complex calculations, and ever-changing regulations often lead to errors and inefficiencies, including:

- Delayed payments: Incorrect billing can delay collection of plan premiums, affecting cash flow and member satisfaction.

- Compliance issues: Non-compliance with CMS regulations can lead to penalties and jeopardize access to crucial programs.

- Resource utilization: Rectifying errors consumes valuable time and resources that could have been utilized for better patient care.

However, there is a solution. Mirra's platform for premium billing in healthcare streamlines the entire Medicare Advantage billing process, automating tasks, minimizing errors, and ensuring seamless compliance.

This empowers you to:

- Focus on what matters most: Providing quality care to your members.

- Boost efficiency: Save time and resources by streamlining cumbersome processes.

- Reduce errors: Ensure accurate billing and timely reimbursement.

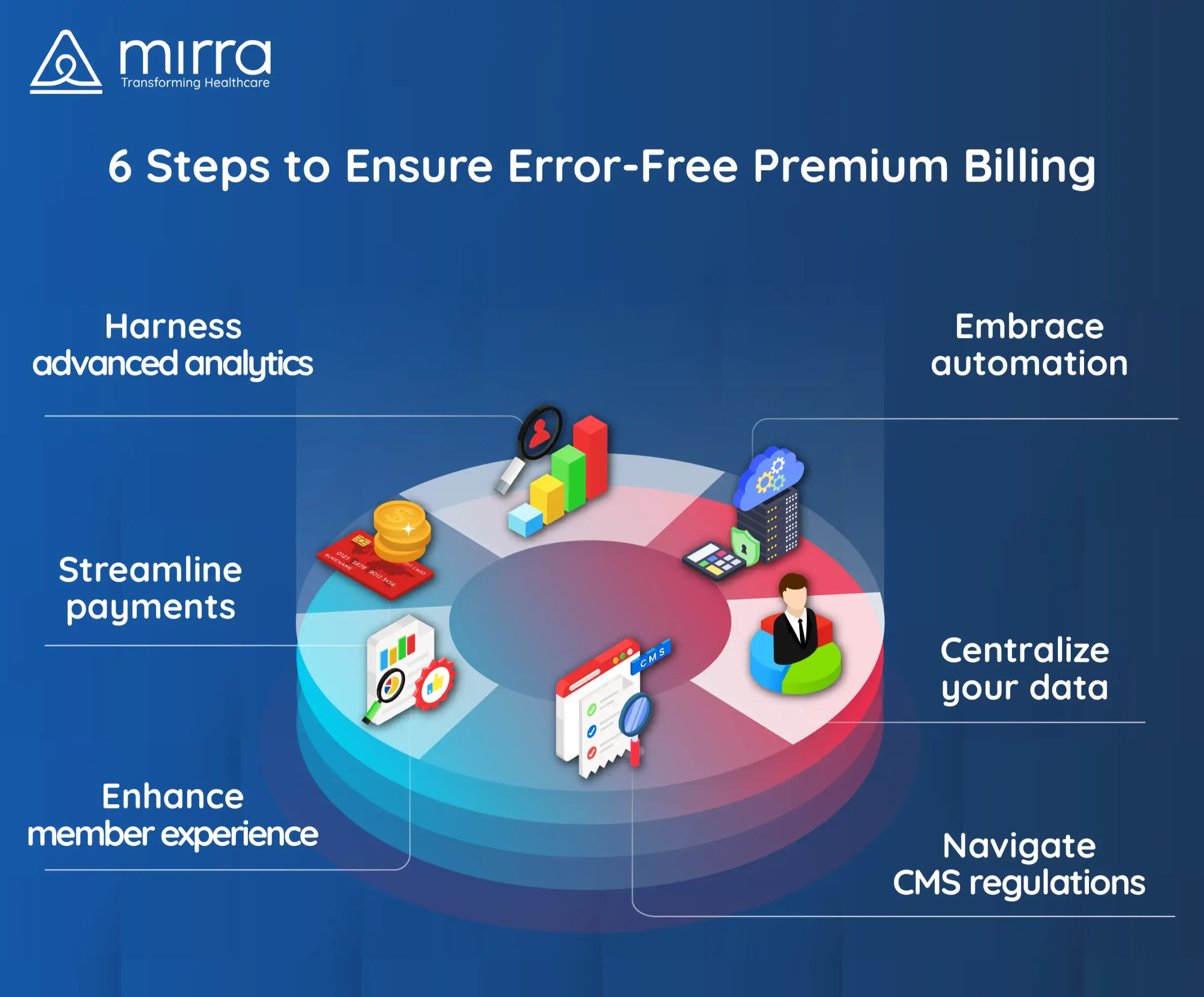

Continue reading to explore the seven steps powered by Mirra Health Care's Premium Billing to navigate the complexities of MA billing and achieve greater accuracy and efficiency.

Step 1: Embrace Automation for Streamlined Workflows

Manual processing in Medicare Advantage (MA) billing leads to errors and inefficiencies, especially with repetitive tasks such as:

- Enrollment processing and eligibility verification: Verifying member information and eligibility can be time-consuming and prone to human error.

- Premium calculations: Complex calculations for monthly premiums, including retroactivity related to CMS enrollment, LIS or LEP changes, can lead to mistakes if done manually.

- Invoice generation and payment posting: Manually generating invoices and posting payments can be tedious and inefficient, impacting cash flow and member satisfaction.

Mirra's TPA Premium Billing solution combats these challenges by automating these critical workflows. The features of our solution allow you to:

- Automatically process enrollment and verify member eligibility against real-time databases, minimizing errors and freeing up staff for more strategic tasks.

- Ensure regular auto-update of invoices for all retroactivity related to CMS enrollment, LIS or LEP changes

- Generate and post invoices automatically, streamlining your billing process and improving cash flow predictability.

By embracing automation with Mirra's Premium Billing, you can significantly reduce errors, save valuable time and resources, and focus on delivering quality care to your members.

Step 2: Centralize Your Data for Precise Insights and Enlightened Choices

Picture managing scattered information spread across multiple databases and spreadsheets. This is a reality for many healthcare organizations, resulting in:

- Inaccurate reporting: Inconsistent data across systems undermines the accuracy of reports crucial for financial analysis and performance tracking.

- Compliance challenges: Difficulty in tracking and monitoring regulatory requirements across various data sources increases the risk of non-compliance.

Explore Tech's Role in Accurate Medicare Reimbursements & Premium Billing

Mirra's solution for premium billing in healthcare provides a central data hub, eliminating data silos and consolidating all your Medicare billing services’ information. It enables you to:

- Generate precise and dependable reports: Gain clear insights into financial performance, spot trends, and make informed business decisions based on a single, reliable data source.

- Ensure effortless compliance: Easily track and monitor adherence to CMS regulations with centralized data readily available for audits and reviews.

If you centralize your data with Mirra Health Care's TPA Premium Billing, you gain a comprehensive view of your MA operations. It enables informed decision-making, simplifies the tracking and reconciliation process for LIS & SSA, and streamlines compliance management. As a result, it allows you to focus on what matters most – providing exceptional patient care.

Step 3: Navigate CMS Regulations with Ease

Staying compliant requires constant attention, as non-compliance can lead to:

- Delayed or incorrect reimbursements: Non-compliance can also cause delays or errors in receiving reimbursements, affecting cash flow and your ability to deliver quality care.

- Reputational harm: Repeated non-compliance can harm your organization's reputation, risking patient trust and referrals.

Mirra's TPA Premium Billing helps you confidently navigate CMS regulations with several features:

- Integrated compliance checks: The platform automatically identifies potential compliance issues during billing processes and enables proactive resolution.

- Regular updates: Mirra's team stays current on CMS regulations, ensuring the platform reflects changes and reducing the need for constant monitoring.

- Comprehensive audit trails: Detailed audit trails of all billing activities provide clear documentation for CMS audits and investigations.

By using Mirra's Premium Billing, you can significantly lower the risk of non-compliance, streamline your auditing process, and free up staff for other crucial tasks. As a result, you can provide quality care to your members with peace of mind, knowing you are operating within regulatory guidelines.

Explore how to Simplify Premium Billing Process with Bank Lockbox | Mirra HC

Step 4: Harness Advanced Analytics for Informed Decision-Making

Manual data analysis is time-consuming and error-prone. Advanced member billing software has built-in analytics features that enable you to identify trends in diagnosis, utilization patterns, and risk factors to tailor care management strategies.

Mirra Health Care's Premium Billing offers integrated analytics dashboards and reporting tools, enabling you to:

- Monitor key performance indicators (KPIs) in real- Track metrics and financial performance for informed decision-making.

- Identify trends and patterns: Gain insights into member demographics, utilization trends, and potential coding errors for targeted interventions.

- By leveraging advanced analytics with Mirra's Premium Billing, you can use evidence-based insights for resource allocation, care management, and population health initiatives.

Embrace data-driven healthcare with Mirra's Premium Billing to enhance quality, efficiency, and financial performance in your MA organization.

Step 5: Streamline Payments with Secure and Convenient Options

Gone are the days of relying solely on paper checks, which can be slow, prone to errors, and inconvenient for both members and providers.

Here's why diverse and secure payment methods are crucial:

- Increased member satisfaction: Members appreciate the flexibility and ease of paying bills online, via a mobile app, or other digital channels.

- Improved efficiency: Electronic payments eliminate the need for manual processing and reconciliation, saving time and resources for your organization.

- Reduced errors: Electronic transactions minimize the risk of errors associated with manual check processing.

Mirra's Premium Billing provides a range of secure payment options, including:

- Credit and debit cards: We can set up automatic recurring monthly charges for both credit and debit cards for convenience.

- Lockbox payments: Enable secure processing of mailed checks and remittances.

Beyond offering diverse options, Mirra prioritizes the security of all financial transactions through:

- Encryption technology: Protects sensitive financial data during transmission and storage.

- Compliance with industry standards: Ensures adherence to data security regulations like PCI DSS.

By providing a variety of secure and convenient payment methods, Mirra's Premium Billing empowers you to:

- Enhance member experience: Offer flexible, user-friendly payment options that meet individual preferences.

- Boost operational efficiency: Streamline payment processing and reduce administrative burdens.

- Minimize errors and risks: Ensure secure and reliable financial transactions.

Embrace a seamless and secure payment experience for both members and providers with Mirra's Premium Billing.

Step 6: Enhance Member Experience with Transparent Communication

Confusing medical bills and unclear billing practices can lead to frustration, dissatisfaction, and delays in payments for your organization.

Here's why focusing on member communication is crucial:

- Increased member satisfaction: Clear explanations of bills and procedures build trust and positive relationships with members.

- Improved payment accuracy and timeliness: When members understand their bills, they're more likely to pay them correctly and on time, enhancing your organization's cash flow.

- Reduced administrative burden: Clear communication upfront reduces the need for member inquiries, saving time and resources.

Mirra Health Care’s Premium Billing enables you to prioritize your member experience through:

- Clear billing explanation: Bills clearly outline service descriptions, costs, and coverage information.

- Automated notifications: Timely updates on payment due dates and coverage issues keep members informed and engaged.

By promoting clear communication with Mirra's Premium Billing, you can:

- Empower members: Provide them with the required information to understand and manage their healthcare expenses.

- Enhance member experience: Build trust and positive relationships through transparency and clarity.

- Streamline operations: Reduce administrative burden and improve efficiency.

Invest in clear communication today to improve member satisfaction and potentially your bottom line.

The Bottom Line: Achieve Error-Free Medicare Advantage Billing

Mirra Health Care’s TPA Premium Billing offers a comprehensive solution that addresses all these aspects, helping you achieve error-free MA billing.

Ready to streamline your Medicare Advantage operations, improve efficiency, and enhance member experience? Contact Mirra today for a free consultation and discover how we can help you navigate the complexities of MA billing with confidenc