Efficient premium billing processes hold paramount importance when it comes to healthcare financial management. Bank Lockbox Services emerge as a pivotal tool in ensuring streamlined premium payment operations, bolstering the revenue cycle managementof healthcare entities.

Mirra Health Care's Premium Billing Solution harmonizes seamlessly with Bank Lockbox Services, revolutionizing premium billing management for healthcare providers. This partnership generates a nexus of speed, precision, and automation in managing premium payments, fostering improved cash flow, diminished administrative burdens, and a more pronounced focus on patient care management.

Continue reading to explore the instrumental role of Bank Lockbox services in facilitating a streamlined, efficient, and error-free premium billing process.

What is a Bank Lockbox Service?

Bank Lockbox Services represent a fundamental cog in the wheel of healthcare finance, simplifying payment processing and revenue cycle management. Offered by financial institutions, these services create secure collection points utilizing designated P.O. Boxes or electronic addresses. These centralized mailboxes cater to various payments, ensuring swift, organized, and secure premium payment processing.

Understanding Bank Lockbox Service Components

In Bank Lockbox Services, the following key components collaborate to streamline payment processing for healthcare businesses:

Banks: Central Hubs

Banks serve as central repositories, securely consolidating incoming premium payments.

Post Office Boxes: Collection Points

Post office boxes act as collection points, efficiently gathering physical premium payments.

Processing Centers: Operational Cores

These centers, whether staffed or automated, function as operational cores. They convert physical premium payments into digital formats through a sequential workflow from post office boxes to processing centers.

Benefits of Using Bank Lockbox Services

-

Accelerated Processing

Bank Lockbox Services significantly expedite payment processing. Businesses witness faster turnaround times from payment reception to processing by centralizing collections and employing streamlined workflows.

-

Enhanced Accuracy

The automated nature of lockbox services minimizes manual errors. This translates to increased accuracy in payment matching, reducing discrepancies and ensuring precise financial records.

-

Improved Cash Flow

The swift and accurate processing facilitated by lockbox services improves cash flow management. Healthcare entities can better predict, and plan based on timely and reliable revenue streams.

-

Time and Resource Savings

Efficiency gains translate to saved time and resources. Healthcare organizations can refocus internal resources on core functions by outsourcing payment processing intricacies to lockbox services, fostering overall operational productivity.

-

Seamless Integration

Lockbox services seamlessly integrate with existing financial systems. This compatibility ensures a smooth transition and operation within the established frameworks of healthcare financial management.

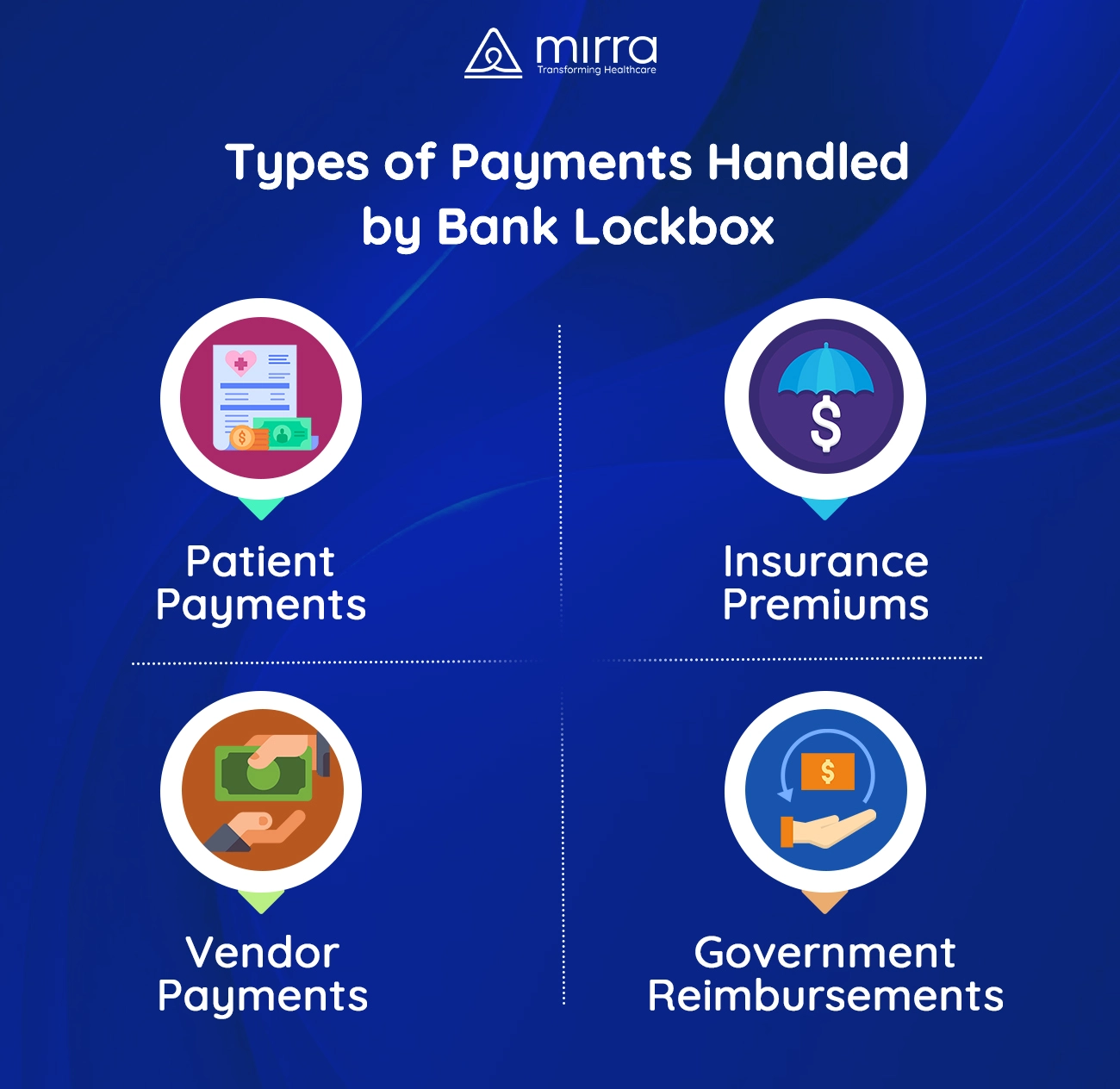

Types of Payments Handled by Bank Lockbox Services

Bank Lockbox Services cater to a diverse array of payments, adapting to the multifaceted financial landscape of healthcare businesses:

-

Patient Payments

Lockbox services efficiently manage patient payments, ensuring seamless processing of medical bills, co- pays, and other healthcare-related expenses.

-

Insurance Premiums

For insurance entities, lockbox services facilitate the collection of premiums. This includes both individual and corporate insurance payments.

-

Vendor Payments

Healthcare organizations often engage with various vendors. Lockbox services extend their capabilities to handle incoming vendor payments.

-

Government Reimbursements

Lockbox services play a pivotal role in processing reimbursements from government healthcare programs. This includes payments from Medicare, Medicaid, and other state-sponsored initiatives.

The Role of Bank Lockbox in Mirra's Premium Billing Solution

Mirra's Premium Billing Solution leverages the efficiency and precision offered by Bank Lockbox Services to optimize premium billing management for healthcare providers.

-

Streamlined Premium Billing Workflow

Integration with Bank Lockbox enables a seamless premium billing workflow, linking billing initiation to secure payment processing.

-

Swift Revenue Cycle Management

Collaborating with Bank Lockbox expedites the revenue cycle, ensuring prompt handling of premium payments for quicker financial turnover.

-

Enhanced Accuracy in Financial Records

In partnership with Bank Lockbox, Mirra ensures precise financial reconciliation, minimizing discrepancies and ensuring financial accuracy.

-

Check Images for Simplified Auditing

As part of lockbox processing, check and payment coupon images are provided for convenient access when auditing or resolving payment questions, saving significant time.

-

Automated Multi-Party Payment Processing

The lockbox seamlessly handles complex payment scenarios like combined premium checks for multiple enrolled members, eliminating manual intervention.

-

Security and Compliance with Mirra's Premium Billing Solution

Security measures and regulatory compliance are at the core of Mirra's Premium Billing Solution. Industry-standard data encryption protocols, adherence to compliance standards, secure payment channels, and continuous monitoring ensure a fortified and protected payment processing ecosystem.

The Bottom Line

Elevate your healthcare business's financial workflows by harnessing the synergy between Mirra's Premium Billing Solution and Bank Lockbox Services. Seamlessly transition from premium billing initiation to secure, efficient payment processing.

Experience the future of precision, efficiency, and security in healthcare finance through Mirra's advanced Premium Billing Solution integrated with Bank Lockbox Services. Schedule a demo now!