Did you know that about half of insured adults rate their insurance plan negatively due to higher premiums and complex billing processes?

For Medicare Advantage plans, member satisfaction and loyalty are the two most important aspects of growing their business. Yet, a seemingly mundane aspect of the member experience – healthcare premium billing - often gets overlooked. A smooth, efficient, and transparent premium billing process can significantly impact how members perceive your health plan, ultimately influencing their decision to stay or switch.

In this blog post, we will share detailed insights into the connection between healthcare premium billing and member satisfaction. We’ll explore key metrics for measuring member satisfaction with billing, identify common pain points, and understand how TPAs like Mirra’s premium billing solution resolve this issue. So, let’s get started!

Why Premium Billing Matters in the Member Experience Journey in Healthcare?

Steve, a retired banker with memory issues, receives his monthly health insurance bill, which is filled with jargon and unclear charges. It takes him several calls and a discussion with a customer service professional to get clarification on his healthcare premium billing. This experience leaves Steve frustrated as he questions the value he's getting from his health plan.

This scenario, unfortunately, isn't uncommon. Studies show that complex premium billing can:

- Generate negative perceptions about the health plan.

- Lead to delayed payments and increased administrative costs for the health plan.

- Make it difficult to retain members as dissatisfied members are more likely to switch to another health plan with a more user-friendly billing experience.

Measuring Member Satisfaction with Healthcare Premium Billing

The following are some key metrics to analyze member satisfaction:

- Net Promoter Score (NPS): This metric measures customer loyalty and willingness to recommend your plan.

- Member satisfaction surveys: Targeted surveys can provide specific feedback on billing clarity, ease of access, and customer service interactions.

- First Contact Resolution (FCR): It measures the percentage of healthcare premium billing inquiries resolved on the first call.

- Time to resolution: Tracks the average time taken to resolve billing issues, highlighting areas that need improvement.

Strategies to Streamline the Healthcare Premium Billing Process for Health Plans

Here's how you can optimize your healthcare premium billing process to create a more positive experience for members:

- Prioritize clarity and transparency: Use clear language, detailed explanations, and itemized breakdowns in insurance premium bills.

- Offer multiple and convenient payment options: Provide a variety of payment options, including online payments, automatic deductions, and mobile payment solutions.

- Empower your customer service team: Train your customer service representatives to address member billing inquiries with empathy and efficiency.

- Proactive communication: Clearly communicate changes in premiums, including changes in Low Income Subsidy (LIS) or Late Enrollment Penalty (LIS) well in advance, allowing members to plan accordingly.

Mirra's healthcare Premium Billing solution automates the generation of summary invoices and ensures accurate and up-to-date billing information through its integration with the Member Management system. Our summary invoice is less confusing and easier to understand, especially if there are retroactive changes to the amounts. The feature-rich user interface supports customer service teams in efficiently handling inquiries, while extensive audit trails and automated processes save time and reduce errors.

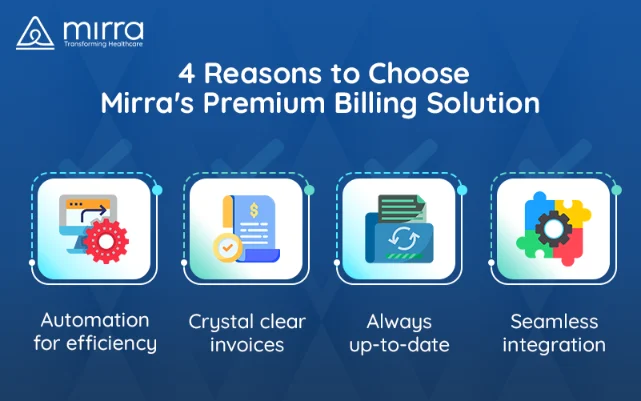

4 Reasons to Choose Mirra's Healthcare Premium Billing Solution

Mirra's Member Billing module goes beyond basic functionalities. It's designed with a holistic understanding of the healthcare ecosystem, keeping member satisfaction at the forefront. Here's how Mirra can empower your health plan:

1. Automation for Efficiency

Mirra’s healthcare premium billing solution automates the process of generating invoices, posting payments, and handling CMS retroactivity. This reduces errors, saves resources, and allows your staff to focus on member needs.

2. Crystal Clear Invoices

Mirra separates member invoices (including LIS credits) from CMS invoices (showing subsidy amounts) in its healthcare premium billing module to ensure everyone has a clear picture of what they're paying for.

3. Always Up-to-Date

Any updates related to CMS enrollment, LIS, or LEP (Late Enrollment Penalty) are automatically reflected in your invoices.

4. Seamless Integration

Mirra seamlessly integrates with your membership management system, eliminating the need for manual data entry of enrollment, termination, and other member information. This feature ensures accuracy and reduces the risk of errors in healthcare premium billing.

Investing in a robust and member-centric billing solution like Mirra demonstrates your commitment to member satisfaction.

Additional Advantages of Mirra's Premium Billing Solution for Health Plans

- Generate Invoice Effortlessly: Mirra’s healthcare premium billing solution automates the creation of monthly invoices for members, Social Security Administration (SSA), and CMS (Centers for Medicare & Medicaid Services) for LIS (Low-Income Subsidy) programs.

- Ensure Retroactive Adjustments: If there's a need to adjust payments due to retroactivity or pre-payments, Mirra facilitates those transfers with ease.

- Get a Complete Picture: Mirra tracks both positive and negative payments from CMS and SSA, providing a comprehensive view of financial transactions.

- Refunds Made Easy: Mirra empowers you to generate member refund checks quickly and efficiently.

By simplifying billing processes, reducing errors, and fostering transparency, Mirra's healthcare premium billing solution saves you time and resources and ensures a positive experience for your members. Partnering with a Third-Party Administrator (TPA) like Mirra empowers you to go beyond simply managing Medicare Advantage premium billing. Our comprehensive Medicare Advantage in a Box Solution allows health plans to get automated and personalized products and services to streamline their operations. Create stronger relationships with your members with us and build a more engaged community. Connect with our experts now!