How to Craft a Balanced Claims Adjudication Strategy for Health Plans

For employers managing self-funded health plans, handling claims isn't just about paying bills—it's about finding the best balance between speed, accuracy, and keeping employees happy. There are two main ways to do this: automated and manual processing. Both have pros and cons, but determining which is right for your plan can be tricky.

This blog post will look closely at both methods and decipher what works and what doesn't, giving you practical advice to help you make the right choice. It will also explain how Mirra Health Care’s Claims Adjudication solution offers a perfect balance. So, let's get started.

Automated Claims Adjudication

For self-funded health plans, navigating the claims adjudication landscape requires speed and efficiency for cost containment and employee satisfaction, yet accuracy remains paramount. Automated claims adjudication emerges as a potential solution, promising lightning-fast processing and streamlined administration. However, concerns regarding its accuracy in handling complex scenarios can leave plan administrators apprehensive.

Read more: 6 Ways Technology Can Enable Accurate Claims Adjudication | Mirra HCThe Automation Advantage

Automated adjudication operates like a well-oiled machine, efficiently processing high claims volumes. By leveraging pre-defined rules and automated verification, it delivers:

- Swift Claim Resolution: Reimbursements reach providers significantly faster, improving cash flow and boosting satisfaction.

- Cost Optimization: Streamlined workflows significantly reduce administrative burden and associated costs to allocate resources to care management practices.

- Scalability: Ideal for growing businesses, the system effortlessly handles increasing claim volumes.

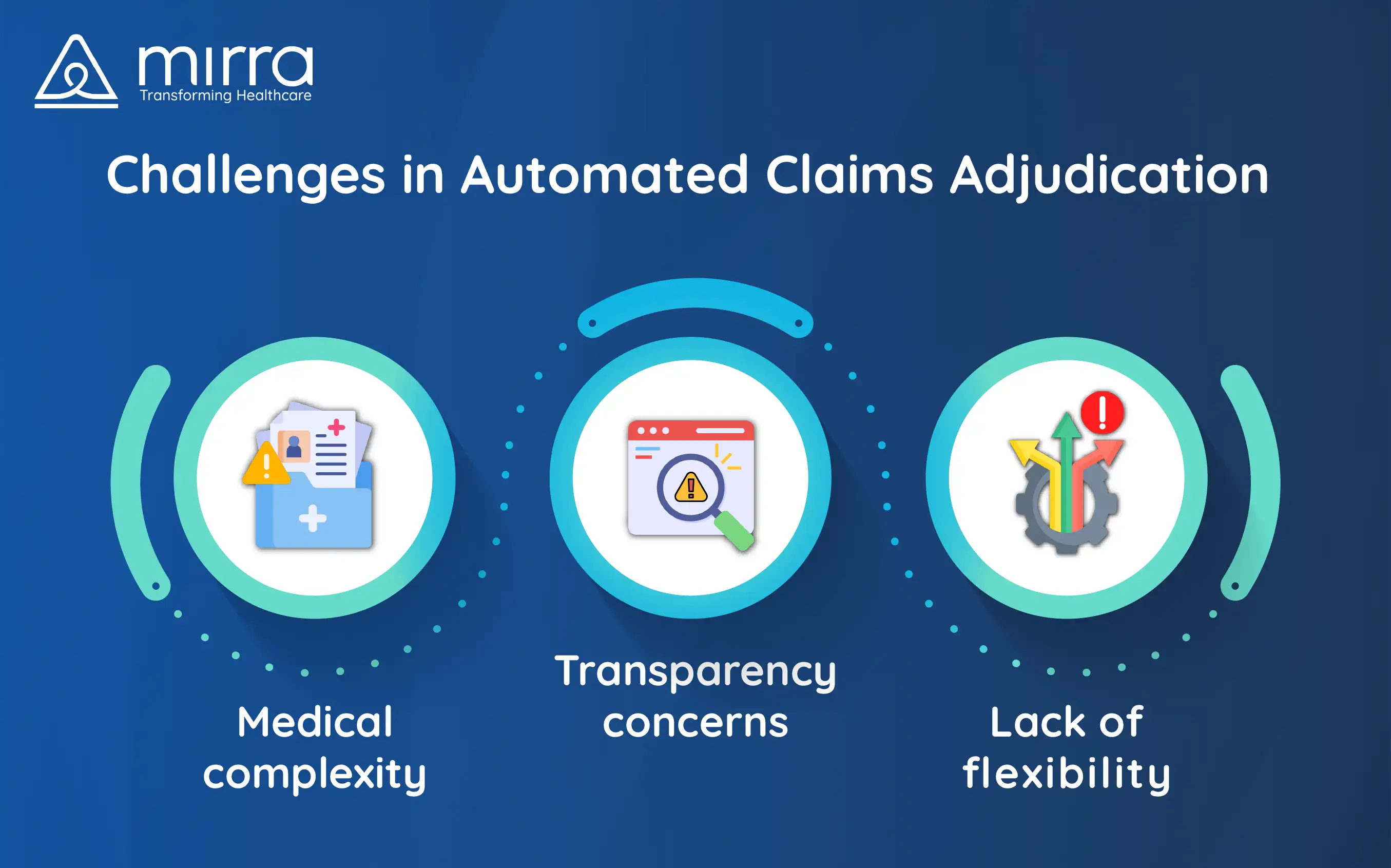

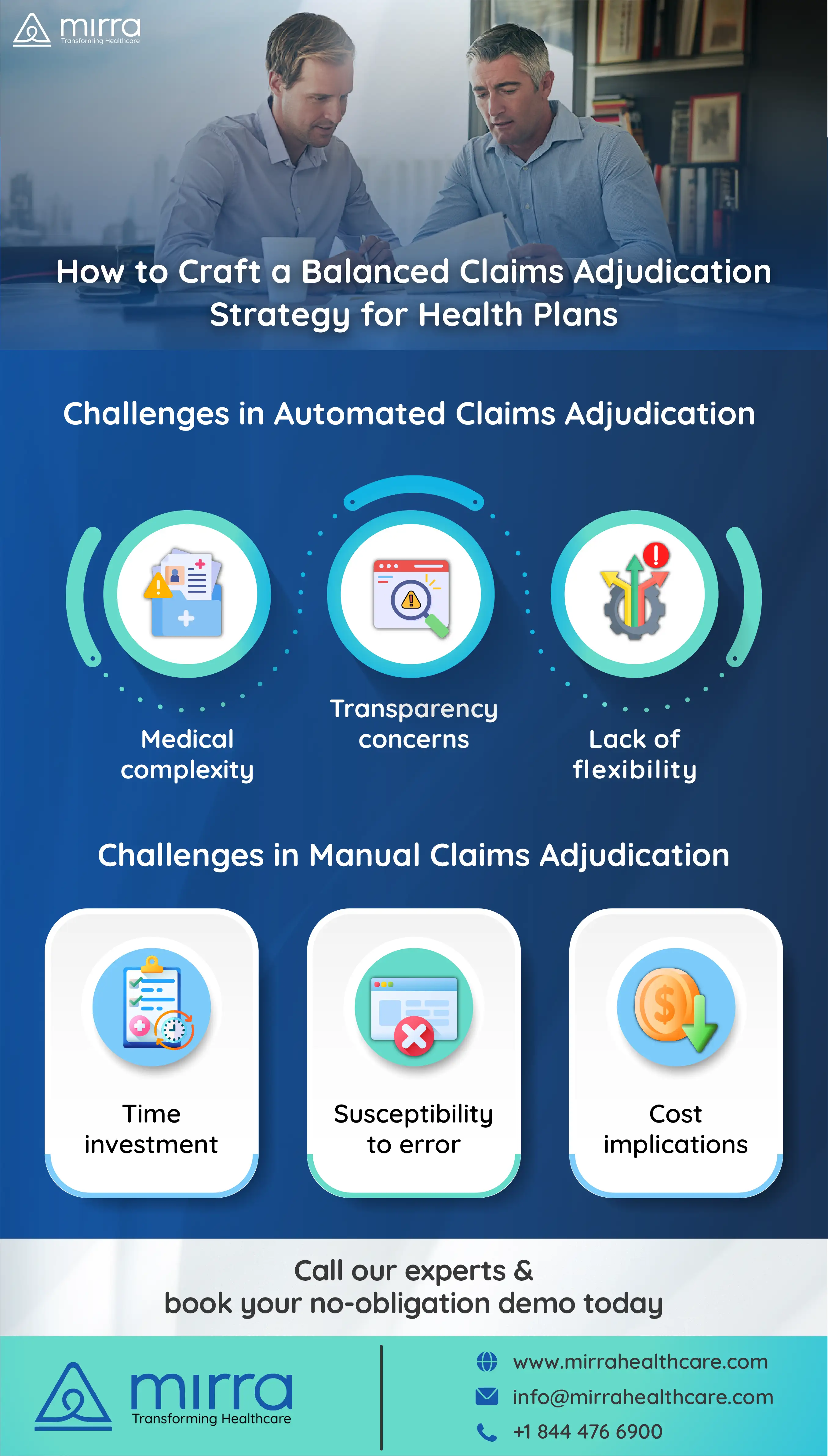

What one needs to be cautious about in Automated Claims Adjudication

Despite its efficiency benefits, concerns linger about potential misinterpretations in complex cases. Automated systems may struggle with the following:

- Nuances in Medical Complexity: Unusual diagnoses or intricate procedures can be misinterpreted, leading to denials and lengthy appeals.

- Lack of Flexibility: Rigid rule-based systems might not adapt well to unique circumstances, requiring manual intervention.

- Transparency Challenges: The automated nature can create a "black box" effect, confusing employees about claim decisions.

Real-World Illustration

Consider a scenario where a mid-sized company implemented automated adjudication. While claims were processed swiftly, an employee's emergency room visit for a rare condition was mislabeled, resulting in a substantial denial. The subsequent manual appeal process caused weeks of frustration and financial stress.

Finding the Right Balance

Automated adjudication offers undeniable advantages, but relying solely on it can be shortsighted. It's crucial to recognize that this technology is a tool, not a cure-all.

Read more: Essential Steps to Improve Claims Adjudication | Mirra HCManual Claims Adjudication

While automation promises speed, a manual claims adjudication process offers a different edge - the human touch. Human expertise steps in where intricate details and unique circumstances arise, ensuring accuracy and fostering trust. But is manual adjudication a silver bullet? We delve into its strengths, weaknesses, and real-world impact.

The Human Touch Advantage

Manual adjudication involves trained professionals meticulously reviewing each claim. This in-depth analysis allows for the following:

- Precision in Complexities: When diagnoses are rare or procedures are unusual, human judgment navigates ambiguities, preventing misinterpretations and potential denials.

- Flexibility for Nuances: Unlike rigid rules, human understanding adapts to extenuating circumstances, ensuring fair claim decisions amidst unique patient situations.

- Personalized Attention: Manual reviewers can directly engage with healthcare providers and employees, clarifying details and fostering trust.

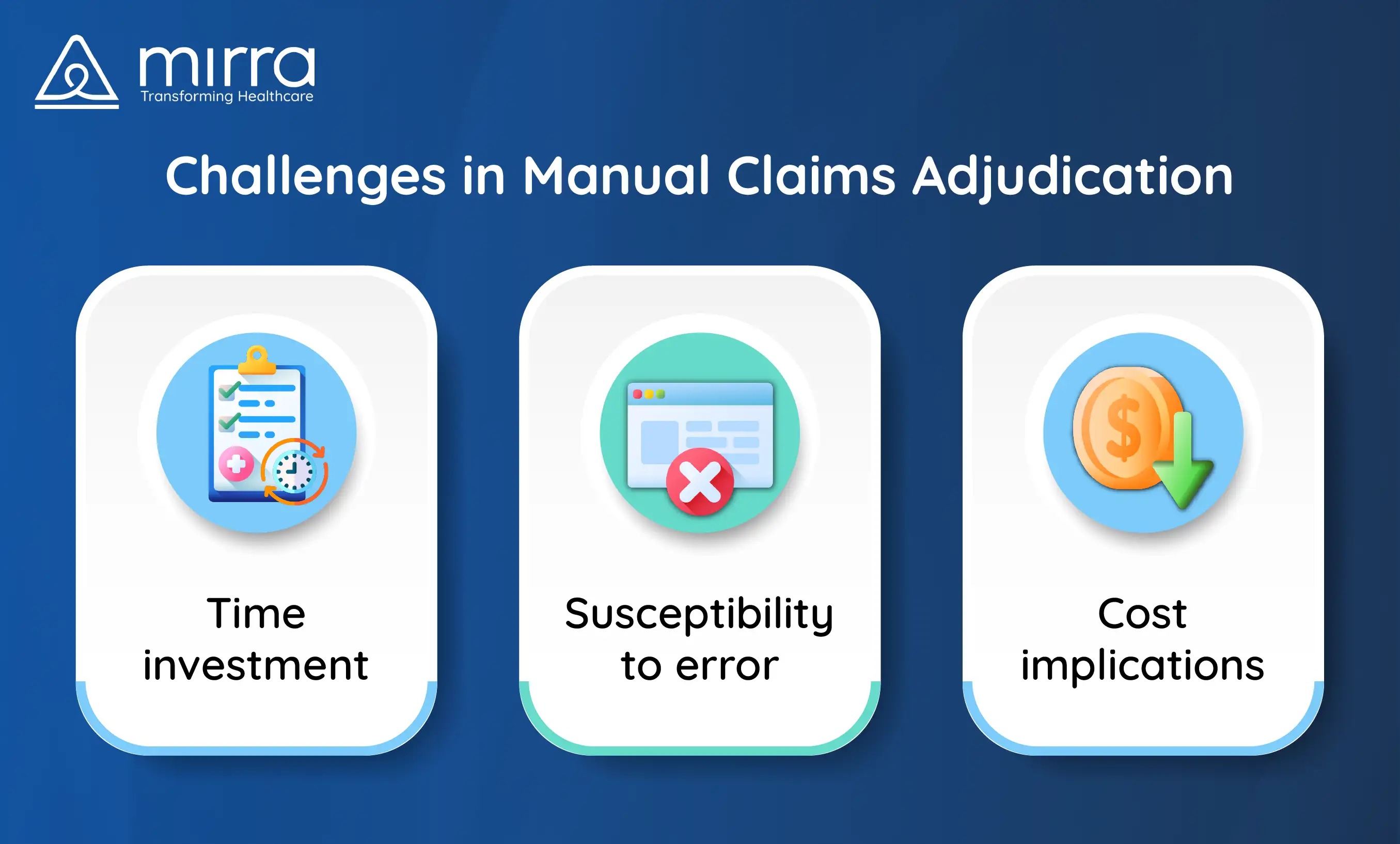

What one needs to be cautious about in Manual Claims Adjudication

Despite its strengths, manual adjudication comes with its own set of considerations:

- Time Investment: Each claim receives individual attention, leading to longer processing times than automation.

- Susceptibility to Error: Manual intervention isn't immune to human error, requiring robust quality control measures.

- Cost Implications: The human resources involved translate to higher administrative costs than automated systems.

A Real-World Illustration

Consider a young employee diagnosed with a rare genetic condition. Their complex treatment triggered an automated denial due to misclassification. Manual review by a trained adjudicator identified the error, ensuring timely claim approval and alleviating financial stress for the employee.

Finding the Right Balance

Neither automated nor manual adjudication exists in a vacuum. The key lies in understanding their strengths and weaknesses to craft a balanced approach. Look for solutions that seamlessly integrate both:

- Leverage automation for routine claims: Free up human expertise for complex situations.

- Implement clear guidelines: Ensure consistency and accuracy in manual reviews.

- Invest in training and technology: Empower manual reviewers with advanced tools and knowledge.

Building Trust Through Transparency

Ultimately, the goal is to create a claims adjudication process that is accurate and transparent. Clear communication with employees about claim decisions, regardless of the adjudication method, fosters trust and reinforces their confidence in the plan.

Remember, the ideal approach hinges on your plan's unique needs and priorities. By understanding the nuances of automated and manual adjudication, you can create a system that delivers efficiency, accuracy, and, most importantly, a positive experience for your employees.

Finding Your Perfect Fit: How Mirra Health Care Can Guide You

Navigating the adjudication landscape can feel overwhelming, but you don't have to go at it. One thing about Mirra Health Care that stands out is that here we understand the unique challenges self-funded plans face and are here to help you craft a claims management solution tailored to your needs.

Beyond Automation vs. Manual

Mirra goes beyond the binary debate. We offer a comprehensive suite of adjudication solutions designed to leverage automation and manual review strengths, creating a dynamic and adaptable approach.

Our Expertise, Your Advantage

- Advanced Technology: Our cutting-edge adjudication platform streamlines claim processing, reduces errors, and provides real-time data insights.

- Dedicated Specialists: Our team of experienced professionals offers personalized support and guidance throughout the process.

- Data-Driven Approach: We leverage data analytics to identify trends, optimize your plan's performance, and minimize financial risks.

The Bottomline: Ready to Find Your Balance?

Mirra Health Care is your trusted partner in navigating the claims management maze. Contact us today

for a no-obligation consultation and discover how we can help you create a solution that delivers both

financial stability and a positive employee experience.

Remember, the ideal claims adjudication approach is not a one-size-fits-all solution. Let Mirra Health

Care guide you toward a tailored strategy that optimizes your plan's financial health and fosters

employee satisfaction.

Reviews & Testimonials

Contact Us

Are you Medicare Advantage Health Plan looking for digital transformation TPA? Let’s connect.