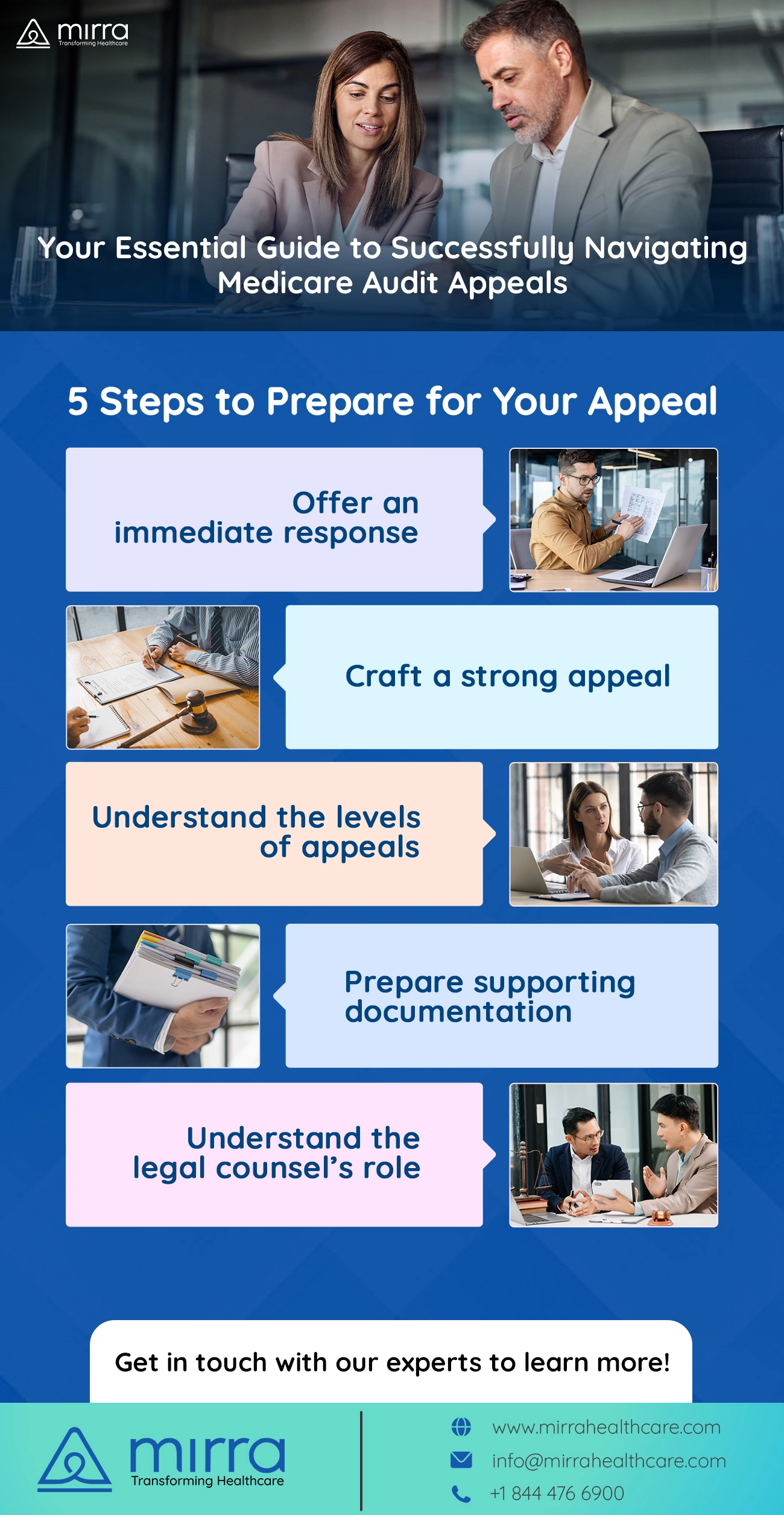

Your Essential Guide to Successfully Navigating Medicare Audit Appeals

A CMS audit, in simple terms, is like a health checkup for healthcare providers. The results, however, aren't just about your health but the health of your organization's finances and reputation. They can make a huge difference to the performance and success of your healthcare business.

However, during this 'health checkup,' the results may not always align with your organization's expectations. The audit may reveal challenges such as deviations from regulations, incomplete processes, data inaccuracies, and lapses in compliance documentation. These challenges can cascade into a series of detrimental effects, including financial penalties, payment recoupments, sanctions, eroded patient trust, strained relationships with partner organizations, and a tarnished reputation. In such scenarios, the significance of Medicare appeals becomes the next course of action to set things right.

Let's break it down even more. Think of Medicare audit appeals like a second opinion from another doctor when you're not sure about your diagnosis. You can say, "Hey, I don't think my diagnosis is correct, and I would like a second opinion." This is why these appeals are super important and can get you the desired results.

Here's a real example: Imagine, out of 100 healthcare providers like your organization, 10 of them thought the audit's results were wrong. So, they decided to challenge these results through appeals. Guess what happened? 7 out of these 10 organizations got the audit results changed in their favor! That's a huge deal. It means that if you believe the audit got it wrong, you have a good chance to fix it with these appeals.

In this blog post, we won't just tell you about appeals; we'll show you the "what," "why," and "how" of these appeals. We will provide you with the steps to confidently navigate Medicare audit appeals and deliver results for your organization. So, let's get started.

The Importance of Medicare Audit Appeals

In healthcare, compliance is the cornerstone of trust and quality. Ensuring adherence to healthcare regulations is vital as it extends far beyond financial consequences. An unfavorable result in a CMS audit can spark uncertainty among patients and partners. It raises questions about the quality of care management services and the ability to meet stringent healthcare regulations. Healthcare providers are traditionally held to the highest standards.When compliance falters, so does trust in an organization's commitment to stakeholder well-being, putting reputations and partnerships on the line.

When faced with these challenges, The Medicare appeals process can serve as your solution. They serve a dual purpose: not only do they assist in reducing financial penalties, but they also offer a vital opportunity to rebuild trust and credibility. Healthcare businesses hold trust in high regard; appeals provide a second chance to showcase your commitment to compliance, ultimately benefiting your partnerships and the well-being of patients.

The Lifeline of Appeals

However, there's a silver lining – the Medicare audit appeals. Think of them as your chance to make amends. They enable an organization to appeal against unfavorable audit results by rectifying errors and protecting the credibility of the organization.

Unpredictable Triggers and Timing

In the world of healthcare audits, the triggers of a failed audit can range from seemingly basic billing discrepancies to intricate coding inaccuracies. Here's the catch: audits can happen at any juncture during your healthcare operations. There's no specific timeline; they're unpredictable and can occur when you least expect them. That's why you should always be prepared for one. Let's look at the steps that you can follow to prepare for your appeal.

Read more: Audits: 4 Reasons Why They Are a Necessity

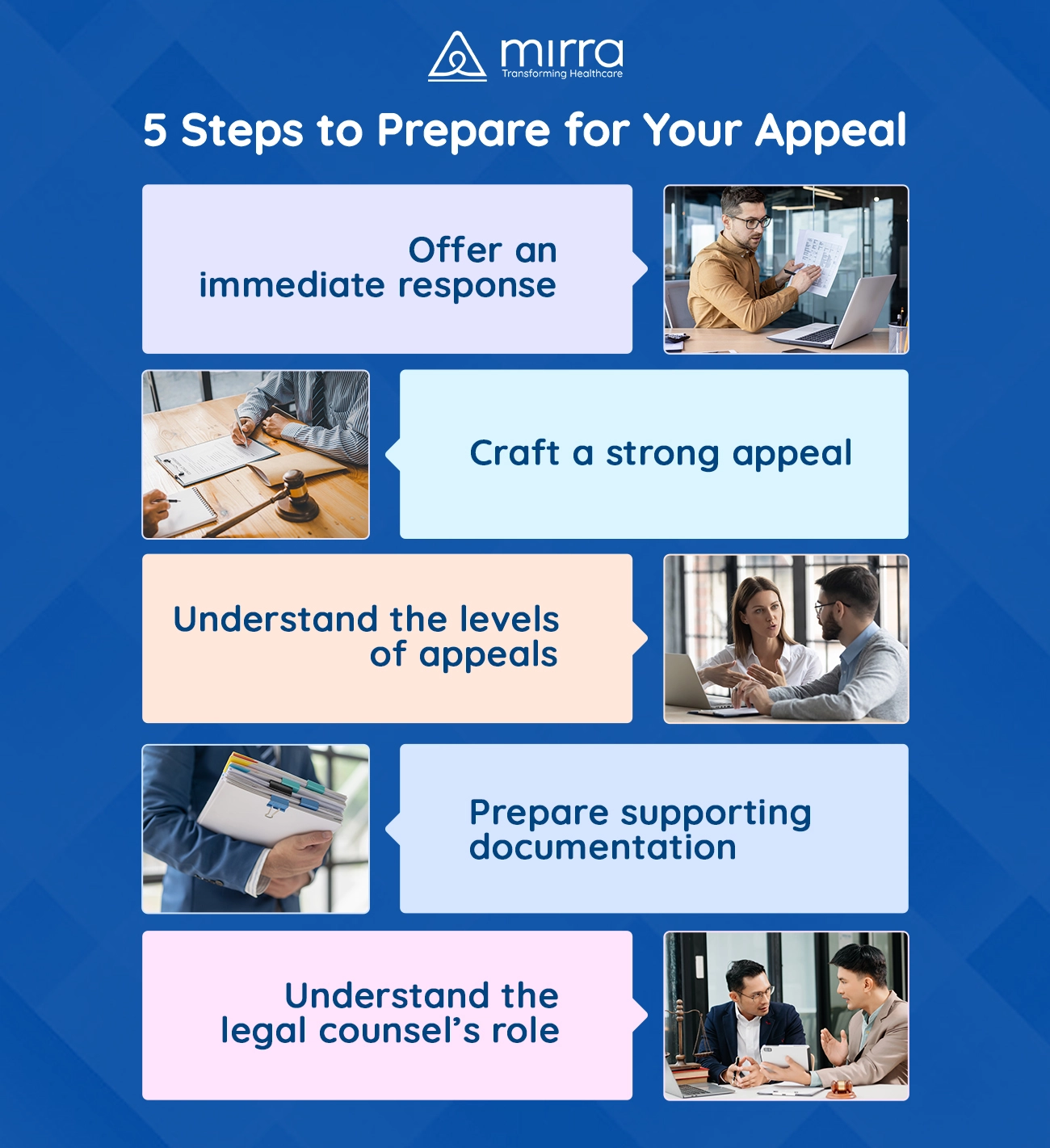

Step 1: Immediate Response and Assessment Essentials

Swift Legal Involvement

The moment an audit find lands, immediately engage your legal counsel. They're your anchor in this process, well-versed in healthcare law and audit intricacies.

Exit Conference: A Must

Request an exit conference with the auditors. This formal meeting will enable you to understand the following:

- Gain a deeper understanding of their findings.

- Seek clarifications on potential concerns.

- Ensure both parties are on the same page regarding findings.

Taking these prompt actions can set the stage for a strong appeal. Your legal team, along with insights from the exit conference, will then shape your strategy to enable a successful outcome. In the next section, we'll detail the steps to prepare a compelling appeal.

Step 2: Crafting a Strong Appeal

Your appeal is your second chance to rectify the situation. It's crucial to approach this phase systematically and meticulously. Here's your roadmap:

-

Know the Regulations Inside Out

Understanding the specific regulations that apply to your case is paramount. It's not just about knowing the rules but also about comprehending how they relate to your situation. -

Meet Deadlines Religiously

Timeliness is of the essence. Missing deadlines can lead to automatic denial of your appeal. Create a schedule and adhere to it strictly. -

Gather and Present Strong Evidence

Your appeal must be evidence-based. Collect all relevant documentation – patient records, policies, and any information that supports your case. The strength of your evidence can significantly impact the outcome. -

Legal Expertise is Non-Negotiable

The appeal process is intricate. Legal counsel experienced in healthcare appeals is your most valuable ally. They'll help you navigate the complexities and ensure all legal aspects are addressed. -

Address Each Point Concisely

Each issue raised in the audit should be addressed clearly and concisely. Detail how you intend to rectify any issues, what measures you've put in place, and why these changes will prevent future occurrences.

Step 3: Understanding the Levels of Appeal

The Medicare audit Medicare appeals process is structured into several levels, each playing a distinct role in addressing the issues at hand. To give you a clear view of this process, here's an overview:

1. Redetermination

- Ojective: At this initial stage, the Medicare Administrative Contractor (MAC) that issued the initial determination reviews your case.

- Procedure: You must file your request for redetermination within 120 days of receiving the initial determination. Ensure that it's in writing and includes all necessary documentation.

- Significance: Redetermination serves as the foundation for the entire Medicare appeals process. Most appeals find a resolution at this stage.

2. Reconsideration

- Objective: If your claim remains unsettled after redetermination, a differerent MAC will conduct a review.

- Procedure: Request a reconsideration within 180 days of receiving the redetermination decision. Provide the requisite forms and documentation.

- Significance: Reconsideration is your opportunity for a fresh perspective on your case. Although more appeals are resolved here, it's an essential step if the initial redetermination doesn't favor you.

3. Administrative Law Judge (ALJ) Hearing

- Objective: If the outcome of reconsideration isn't in your favor, your case advances to the ALJ level, where an independent judge examines it.

- Procedure: Submit a hearing request within 60 days of receiving the reconsideration decision. Your case will undergo a thorough review, potentially involving in-person or video hearings.

- Significance: ALJ hearings are crucial for complex cases. They provide an opportunity for a detailed examination of the evidence and witness testimonies.

4. Medicare Appeals Council Review

- Objective: If you remain dissatisfied with the ALJ's decision, you can request a review by the Medicare Appeals Council.

- Procedure: The request for this review should be made within 60 days of the ALJ's decision.

- Significance: The Medicare Appeals Council serves as the final administrative review level. They may uphold, reverse, or modify the ALJ's decision.

5. Federal Court Review

- Objective: If you still disagree with the Medicare Appeals Council's decision, you can bring your case to a federal court.

- Procedure: This step involves filing a case in federal court within 60 days of receiving the Medicare Appeals Council's decision.

- Significance: A federal court review is a formal legal process and can be more timeconsuming.

Understanding these stages is essential for effectively navigating the appeals process. It's often in your best interest to engage experienced legal counsel to guide you through each level, ensuring that you present the strongest possible case.

STEP 4: Supporting Documentation: Your Best Defense

In Medicare audit appeals, having the right documentation is vital.

The Basics of Documentation

Your supporting documentation should ideally include the following:

- Medical Records: These are of paramount importance, as they provide a precise account of the care administered. Ensuring their accuracy and completeness is imperative.

- Billing and Coding Records: The accuracy of coding and billing records is pivotal. Any errors in this domain can lead to significant repercussions.

- Physician Orders: These documents validate a physician's endorsement of tests, treatments, or services, affirming their medical necessity.

- Protocols, Procedures, Policies, and Guidelines: Maintain comprehensive records of your organization's protocols, procedures, policies, and guidelines. These substantiate your commitment to adhering to established standards and regulations.

Why Details Matter

When it comes to documentation, little details are a big deal. Keep things organized and up-todate. One small mistake can hurt your case.

Don't Miss Deadlines

Remember, there are strict deadlines for submitting documents during an appeal. Missing them can hurt your case. This is where a good lawyer can help you stay on track.

STEP 5: Understanding a Legal Counsel's Role

Experienced legal counsel specialized in healthcare audits can be your most valuable companion. They bring deep knowledge and expertise to the table.

Deciphering Legal Complexities

Healthcare audits involve many complicated legal regulations. Legal advisors are experts at helping you understand and follow these regulations correctly, reducing the chances of mistakes and increasing your audit appeal's success.

Crafting a Winning Strategy

Legal counsel doesn't just interpret the law; they develop a personalized strategy for your appeal. They offer guidance to make a foolproof and correct appeal, significantly enhancing your chances of success.

Your Voice in Legal Conversations

Legal advisors serve as your voice when interacting with auditors and administrative bodies. They speak the legal language fluently, ensuring your arguments are both legally sound and persuasive.

Keeping You on Track

Time is of the essence in appeals. Legal advisors keep you on schedule, ensuring that all your submissions and responses meet crucial deadlines and prevent unnecessary setbacks.

Shielding You from Legal Challenges

When you have a legal team on your side, they act as a shield against legal challenges. They shoulder the legal burdens, allowing your organization to concentrate on its core mission of providing quality care.

A Long-Term Perspective

Your legal counsel isn't just focused on the current appeal. They consider potential long-term consequences, helping your organization make choices that safeguard its future.

Read more: How to Boost Your Healthcare Revenue Cycle | Mirra HCCommon Appeal Pitfalls to Avoid

While Medicare audit appeals offer a lifeline to rectify unfavorable findings, many healthcare organizations are unsuccessful due to common pitfalls. Here's what to watch out for:

1. Ignoring Timelines

Missing deadlines is unacceptable in appeals. Every level of the appeal process has strict timeframes. Failure to meet them can lead to automatic dismissals.

2. Lack of Documentation

Insufficient or inaccurate documentation weakens your case. Ensure every piece of supporting evidence is clear, complete, and directly relevant to the issues raised in the audit.

3. Failure to Understand Regulations

Misinterpreting or misapplying them can jeopardize your appeal. You must seek expert guidance or legal counsel to navigate this complex terrain.

4. Inadequate Legal Representation

Attempting an appeal without legal counsel is risky. Experienced attorneys understand the legal nuances, increasing the chances of a favorable outcome.

5. Misaligned Strategies

Ensure your appeal strategy aligns with the previous audit findings. Develop a tailored approach for each case, addressing the specific issues raised.

6. Inconsistent Communication

Maintain open and consistent communication within your organization. Legal counsel, compliance officers, and operational teams should collaborate closely to present a unified front during the appeal.

7. Neglecting Alternative Solutions

While appeals are essential, consider alternative dispute resolution methods. Sometimes, negotiations or settlements can be more favorable and faster.

8. Overlooking the Importance of the Exit Conference

Don't underestimate the significance of the exit conference. It's a vital opportunity to clarify issues and correct misconceptions before the audit becomes official.

Potential Outcomes of an Appeal

The Medicare audit appeals process is not just a binary win-lose scenario. It offers a spectrum of potential outcomes, each with its implications. Understanding these possibilities is vital for healthcare organizations. Here's what you need to know:

- Overturning the Audit Findings: The ideal scenario is winning the appeal and having the unfavorable audit findings overturned. This means you've successfully defended your claims and can maintain the reimbursements.

- Reduction in Overpayment: Sometimes, it's not a complete victory, but the audit findings are partially reversed. This leads to a reduced overpayment, saving your organization from significant financial losses.

- Repayment without Penalty: In cases where the audit reveals minor issues, you may be required to repay the amount without any additional penalties or legal consequences. This is a favorable outcome.

- Legal Battles: If your appeal is denied, you might opt to continue the fight in court. While this can be a lengthy and expensive process, it's sometimes necessary to protect your organization's interests.

- Settlements or Negotiations: Prior to or during the appeals process, negotiations or settlements may be possible. This can result in a more favorable resolution without the need for protracted legal battles.

- Operational Changes: In some cases, the audit process might reveal operational flaws. This outcome prompts your organization to implement changes to prevent future audit failures.

- Continued Scrutiny: It's essential to be prepared for continued scrutiny, especially if you don't succeed in your appeal. This may involve more frequent audits or closer monitoring.

Navigating these potential outcomes requires a strategic approach, often with the assistance of legal counsel. Each situation is unique, and it's crucial to have a well-thought-out plan in place to respond effectively.

To make this process smoother, we introduce Mirra Health Care's Appeals and Grievances Module, a comprehensive solution tailored for healthcare organizations embarking on the audit appeals journey.

Mirra's Solution: Enhancing Your Appeals Process

Mirra's Appeals and Grievances Solution is designed with a deep understanding of the complex challenges healthcare providers face during audit appeals. It offers a range of features and benefits:

- Streamlined Workflow: Mirra's solution simplifies the entire appeals process, ensuring that every step is well-organized and efficient. This helps your organization respond promptly to audit findings.

- Document Management: Efficiently manage all the documentation required for your appeal. Mirra's platform ensures that you have easy access to essential records and evidence.

- Regulatory Compliance: Stay up-to-date with the ever-evolving healthcare regulations. Mirra's module is regularly updated to reflect the latest compliance requirements.

- Analytics and Insights: Gain valuable insights from your appeals data. Understand the trends, common issues, and areas where your organization can improve to minimize future appeals.

- Experienced Support: Benefit from Mirra's team of experts who can guide your organization through the appeals process. Their experience and knowledge are invaluable in navigating the complexities of audits.

- Cost-Efficiency: Save on the resources required for managing appeals. Mirra's solution reduces the financial burden of the lengthy Medicare Advantage appeals and grievances processes.

With Mirra's Appeals, Grievances, and Claims Tracking module from its Medicare Advantage in a Box umbrella of solutions, you not only have a higher chance of a successful appeal but also a more cost-effective and efficient process. For more information and to explore how Mirra can benefit your organization, click here's time to manage Medicare audit proactively appeals with confidence with Mirra Health Care.

Reviews & Testimonials

Contact Us

Are you Medicare Advantage Health Plan looking for digital transformation TPA? Let’s connect.