Are you looking to secure the best healthcare coverage that suits your needs? Although Medicare Annual Enrollment 2024 is still a few months away, it's never too early to start preparing. This is your chance to take control of your healthcare journey and make informed choices that truly benefit you and your loved ones.

This blog post will equip you with the knowledge and tools required to navigate the upcoming Annual Enrollment Period with confidence. From understanding available plan changes and fixing any mistakes, to getting better value for the money you spend; we've got you covered.

Get ready to unlock a world of possibilities and ensure a healthier, happier future for yourself and your loved ones. Let's dive in and explore the key aspects of 2024 Medicare Annual Enrollment Period.

Understanding Medicare Annual Enrollment

Medicare Annual Enrollment is an important period that empowers you to take control of your healthcare choices. It's the time when you have the opportunity to make changes to your Medicare coverage.

Whether you're currently enrolled in Original Medicare or a Medicare Advantage plan, this period allows you to assess your needs and explore alternatives that may better suit your circumstances. By understanding the options available, you can ensure that you have the right coverage for your medical needs.

Key Dates and Duration of the Enrollment Period

The enrollment period typically runs from October 15th to December 7th each year. It's essential to mark these dates on your calendar and be prepared to make any necessary changes during this time. Missing the deadline could mean having to wait until the following year to make adjustments to your coverage. So, make sure to stay informed and take advantage of this window of opportunity to evaluate and update your Medicare plan for the upcoming year well in time.

Making Changes During Medicare Annual Enrollment

A. Available plan changes during the enrollment period

You have several options to consider:

-

Switching from Original Medicare to Medicare Advantage:

If you currently have Original Medicare and wish to explore additional benefits like prescription drug coverage or vision and dental services, you can switch from Original Medicare to Medicare Advantage/Medicare Advantage Plus Part D Prescription Drug Plan.

-

Switching from Medicare Advantage to Original Medicare:

If you're enrolled in a Medicare Advantage Plan but prefer the flexibility and freedom of Original Medicare, you can make the change.

-

Changing Medicare Advantage plans:

If you're already enrolled in a Medicare Advantage Plan but want to explore different options within this category, you can switch to a new plan that better suits your needs.

-

Switching Medicare Part D prescription drug plans:

If you need to make changes to your prescription drug coverage, you can switch to a different Medicare Part D Plan that covers the medications you need.

-

Enrolling in Medicare Part D if previously not enrolled:

If you don't currently have Medicare Part D coverage but need prescription drug benefits, you can enroll during the annual enrollment period.

Read more: 4 Benefits of Outsourcing to Third-Party Administrators | Mirra HC

B. Difference Between AEP and MAOEP: Flexibility Options

The primary distinction between Medicare Annual Enrollment Period (AEP) and Medicare Open Enrollment Period (MAOEP) lies in the level of options and flexibility they provide. AEP stands out for offering a broader range of choices compared to MAOEP.

To illustrate, during the Medicare Advantage Open Enrollment Period (MAOEP occurs from January 1 to March 31 effective for February 1 to April 1), it is only possible to enroll in a Part D plan make a change if you are currently enrolled in a Medicare Advantage Plan or Medicare Advantage Plan with Part D. You can switch to Original Medicare or a different Medicare Advantage Plan/Medicare Advantage Plan with Part D.

Medicare Annual Enrollment Period allows you to reassess your healthcare needs and make changes that align with your evolving requirements. Whether you want to switch from Original Medicare to Medicare Advantage for additional benefits or transition from Medicare Advantage to Original Medicare for more freedom and flexibility, the AEP is the ideal time to make those adjustments.

You can also explore different Medicare Advantage plans or switch to a new Medicare Part D prescription drug plan that better suits your medication needs. The AEP empowers you to take control of your healthcare coverage and make informed choices for the upcoming year.

C. Fixing mistakes made during the enrollment period

We understand that mistakes can happen, even during Medicare Annual Enrollment. The good news is that the AEP provides an opportunity to rectify any errors or oversights made during the enrollment period. If you realize that you made a wrong decision or accidentally selected the wrong plan, the AEP allows you to correct those mistakes. This ensures that you have the coverage that best meets your healthcare needs and preferences.

Eligibility and Coverage Considerations

A. Who can make coverage changes during Medicare Annual Enrollment?

If you have Original Medicare (Part A and Part B) or Medicare Advantage (Part C), you can explore different options. Additionally, individuals with Medicare Part D prescription drug plans can review and switch plans if needed. It's crucial to understand your eligibility and take advantage of this enrollment period to ensure your healthcare needs are met.

B. Special considerations for Medigap plans

For those enrolled in Original Medicare, also known as Medigap plans, it's important to note that annual enrollment may not apply. Medigap plans have different rules, and the enrollment periods may vary. However, it's still a good time to assess your Medigap coverage and evaluate if any changes are necessary to address your evolving healthcare needs.

Read more: Revolutionize Healthcare Management with BPaaS’ Efficiency|Mirra HC

Recommendations and Best Practices

Benefits of Actively Reviewing and Comparing Available Options

During Medicare Annual Enrollment, taking the time to review and compare your coverage options can bring numerous benefits. By actively exploring different plans, you can ensure that your healthcare needs are met while potentially saving money. It allows you to assess if your current plan still aligns with your changing needs, ensuring you have access to the right doctors, medications, and healthcare services.

Additionally, comparing options helps you identify any new benefits or cost-saving opportunities that may be available to you. By being proactive and staying informed, you can make confident decisions that positively impact your health and finances.

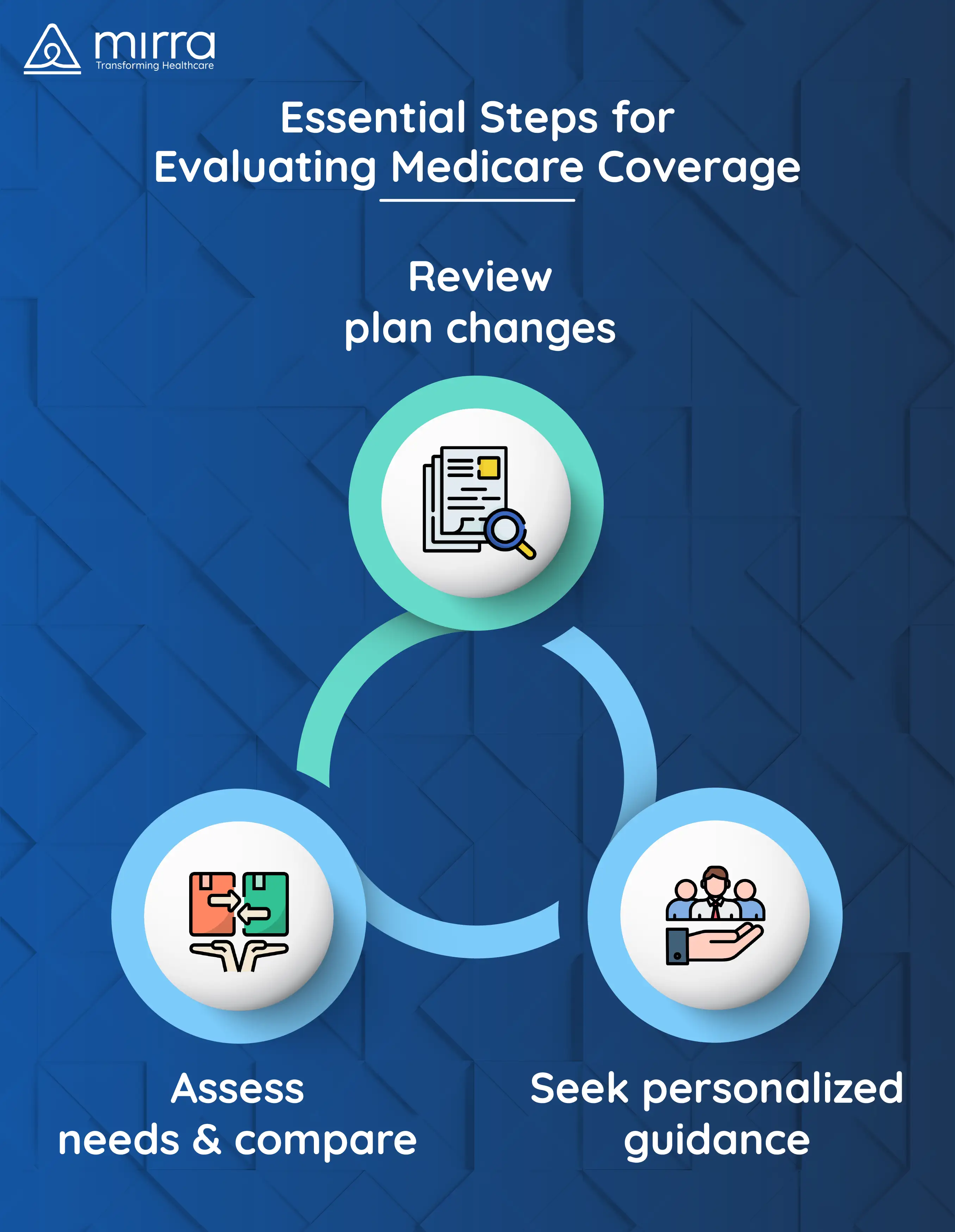

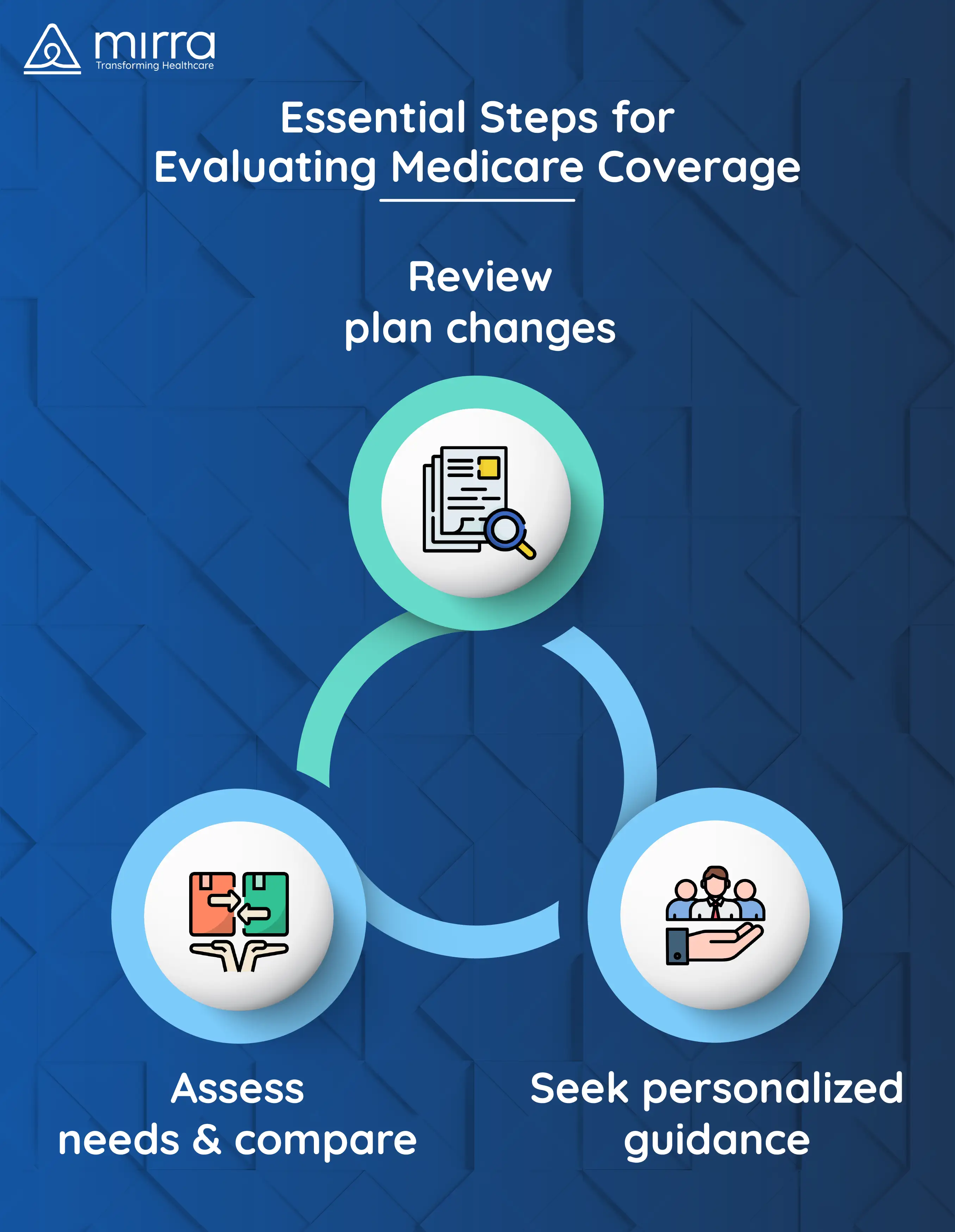

Steps to Take When Evaluating Medicare Coverage for the Upcoming Year

When evaluating Medicare coverage for the upcoming year, consider these steps.

-

First, review any changes to your current plan, including premiums, deductibles, and covered services.

-

Next, assess your healthcare needs and preferences to identify any gaps in coverage. Then, research and compare different plans that are available in your area. Pay attention to factors like network coverage, prescription drug formularies, and out-of-pocket costs.

-

Finally, consider seeking assistance from trusted resources, such as Medicare counselors or insurance agents, who can provide personalized guidance based on your specific needs.

Importance of Selecting a New Plan Before the AEP Deadline

Selecting a new plan before the AEP deadline is crucial to avoid any gaps in coverage. The Annual Enrollment Period (AEP) has specific dates, and if you miss the deadline, you may have to wait until the following year to make changes. By selecting a new plan within the designated timeframe, you ensure a seamless transition and uninterrupted access to healthcare services.

Don't wait until the last minute. Take the time to carefully evaluate your options, compare plans, and make an informed decision before the AEP deadline to secure the coverage that best suits your needs.

The Bottom Line

It is possible to make the best use of the Medicare Annual Enrollment period by using it to review and make informed decisions about your healthcare coverage. Take the time to evaluate your options, compare plans, and consider how they align with your healthcare needs and budget. By doing so, you can maximize the value of your Medicare coverage and potentially find new cost-saving opportunities and better quality of healthcare protection.

For healthcare businesses seeking a comprehensive solution for Medicare Advantage, Mirra Health Care offers Medicare Advantage in a Box. Discover how our innovative solution can streamline operations and enhance patient care. Contact us today to get the personalized assistance you deserve.